Winnow●Wealth

Waco, Texas Financial Planners

Welcome to Winnow Wealth, where financial expertise meets a personal touch. Bringing to you a specialization in ensuring you reach retirement and stay retired. With over 50 years of combined experience and diverse backgrounds, our team is a dynamic force ready to assist clients of all types. From young individuals embarking on their financial journey to established couples planning their retirement and legacy, Winnow Wealth is your trusted partner in streamlining the path to financial efficiency.

The Meaning of Winnow and Financial Efficiency

WINNOW:

(verb) \ˈwi-nō\

To separate the essential parts from the unnecessary waste, leaving what is most valuable.

It’s Time To Get On Track With

Our●Winnow Way●Process

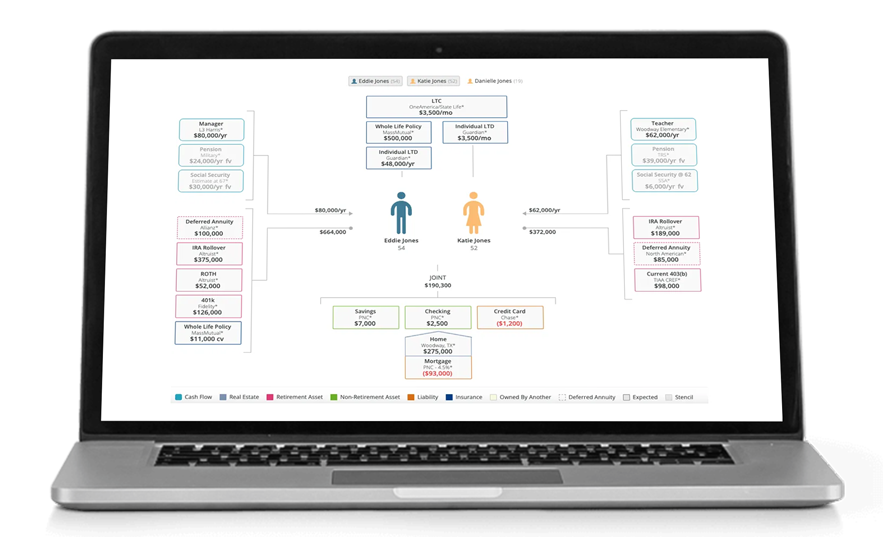

Our approach ensures your financial accounts are streamlined for efficiency and protection. Experience the liberation of financial efficiency, where the burden of juggling accounts and anxieties about retirement fade away, replaced by a sense of control and peace of mind. This allows for a smoother, more confident approach to future planning.

We begin by listening carefully to what is most important to you, your family, your goals, and the legacy you wish to create. This helps us understand the values that guide your decisions and priorities, allowing us to better support your vision. We also take the time to identify any unique challenges or circumstances that may affect your journey. Finally, we introduce our philosophy and process, ensuring that everything we do is aligned with your aspirations and needs.

We start by determining your risk tolerance to ensure our approach aligns with your comfort level. Next, we gather relevant data, documents, and statements for thorough analysis, allowing us to assess your current investments, the course of action, and any potential complications. This process helps us identify areas where we can add value and make informed recommendations as your life continues to unfold, ensuring that your financial strategy evolves with you.

We will begin by discussing your current approach and presenting our tailored recommendations to enhance your strategy. We’ll also go over important details such as account fees, the structure of your accounts, and system access to ensure transparency and clarity. Following this, we’ll review the agreement and disclosures, making sure you understand all aspects. If necessary, we will open new accounts and initiate the transfer of any existing assets to align with your updated financial plan.

We will review the communication agreement and establish the service levels to ensure clear expectations moving forward. Responsibilities will be assigned to ensure everyone is aligned and accountable. To make managing your accounts easier, we will provide a tutorial on how to use the online portal and mobile app. Finally, we will deploy your tailored investment strategy, setting the foundation for your financial journey ahead.

We focus on comprehensive insurance risk management to protect your assets and minimize potential risks. As needed, we will coordinate with your CPA, attorney, or insurance agent to ensure a cohesive approach. We also help manage educational and trust accounts, taking into account your long-term goals. Additionally, we consider charitable giving strategies and integrate them into your plan, along with estate planning and your family’s specific needs, to create a well-rounded and effective strategy for the future.

Before each meeting, we send an agenda to ensure we are aligned on the topics to be discussed. During our conversations, we will focus on potential future transitions and how to prepare for them. We continuously monitor your progress toward achieving your goals, making adjustments to the plan as needed. As your life evolves, we ensure that your financial strategy adapts accordingly, keeping you on track for long-term success.

Complimentary Retirement Resources

Download Our Guide

Important Birthdays Over 50

Turning 50 is a major milestone, especially when it comes to your retirement planning.

But are you aware of the new opportunities and risks that come with it? Our complimentary guide is here to help you navigate these crucial years with confidence.

Download “Important Birthdays Over 50” and discover all the key birthdays in retirement and what they could mean for your finances. From “catch-up” contributions at 50 to the significance of Medicare at 65, this guide covers everything you need to know to make informed decisions. Gain valuable insights that will empower you to secure your financial future and enjoy your retirement to the fullest.