Blog

Check out our latest market updates and important financial alerts

August 2023 Market Watch

August 4, 2023

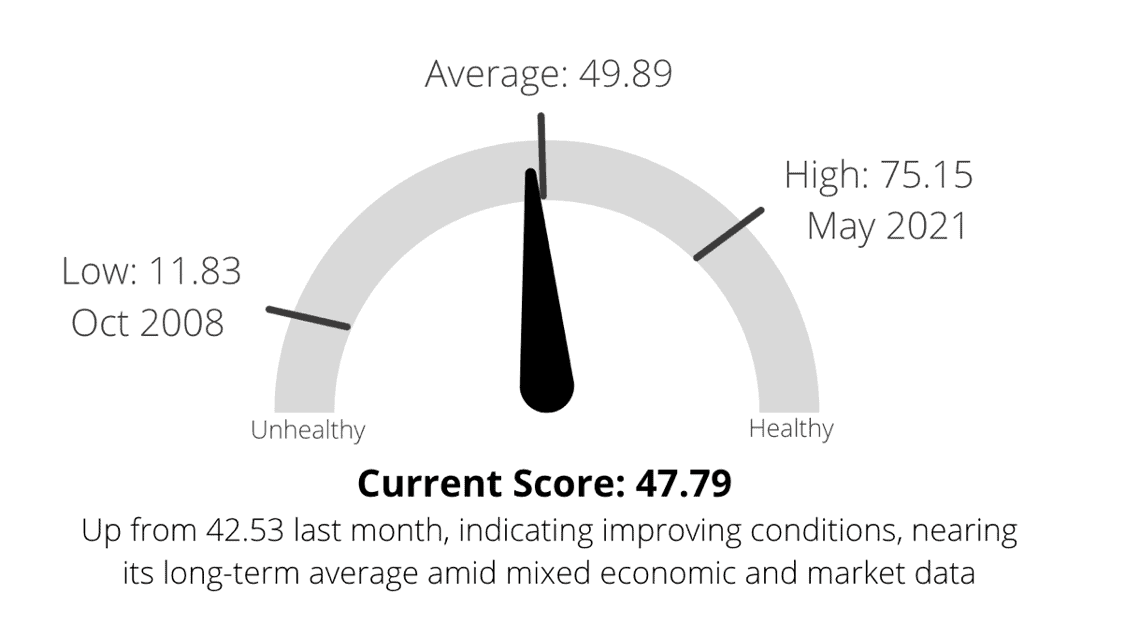

Market Health Indicator - Current Score

The Market Health Indicator (MHI) measures market health on a scale of 0 - 100, analyzing various market segments such as economics, technicals, and volatility. Higher scores indicate healthier market conditions.

Fun in the Sun!

Stocks continued to have fun in the sun as markets extended their summer rally.

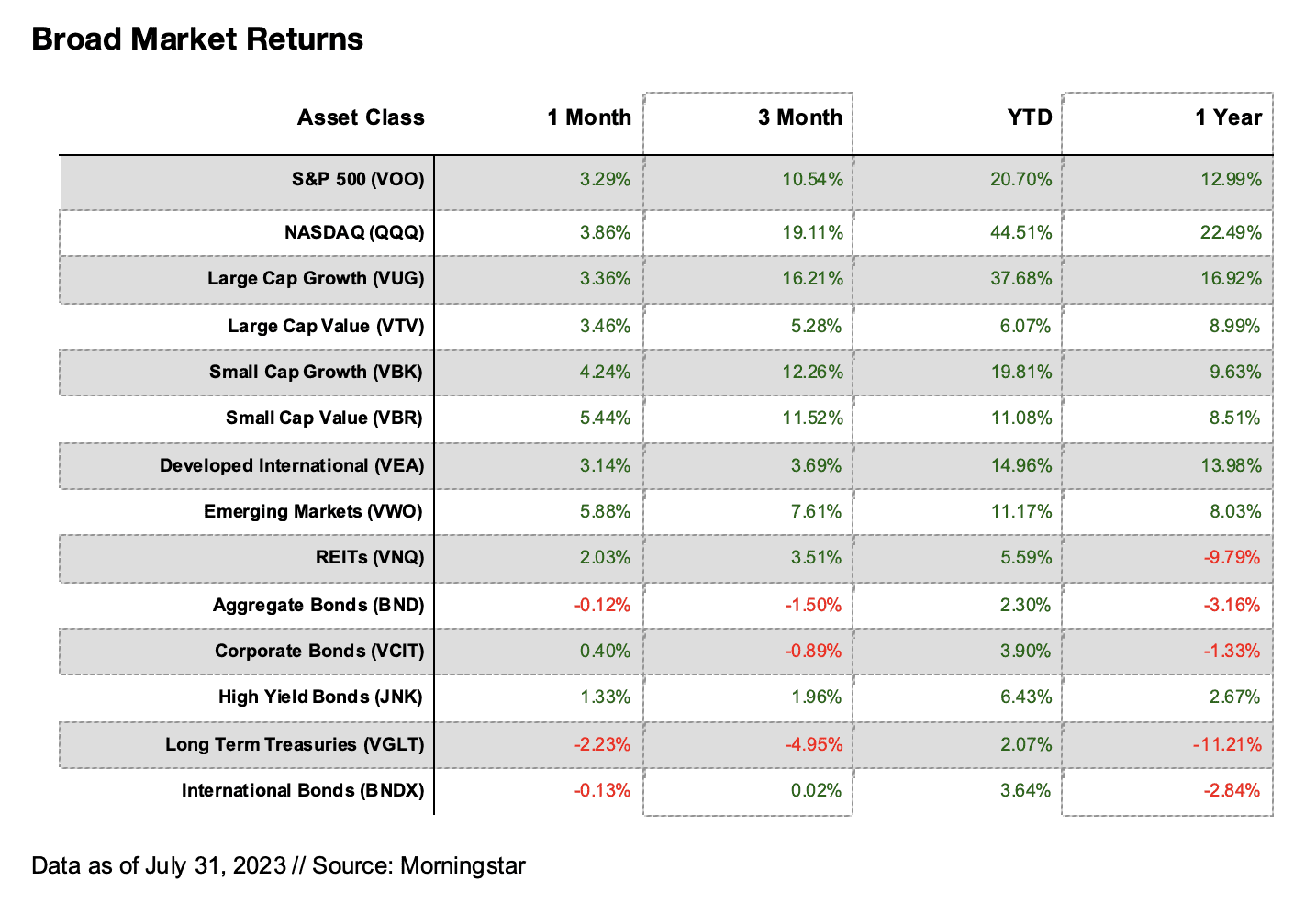

Broadly positive sentiment throughout the month helped major US indices climb higher. Small-cap stocks led the way for the second straight month with the Russell 2000 soaring 6.06%. Powered by stronger than expected earnings and improving economic data, the Nasdaq, Dow Jones Industrial Average, and S&P 500 posted gains of 4.05%, 3.41%, and 3.30% respectively. The Dow even decided to party like it was 1987, logging its longest winning streak in decades with 13 consecutive positive days.

International equities followed the trend higher as developed international stocks gained 3.14% and emerging markets rose 5.88%. Amid disappointing data from China and ongoing geopolitical tensions in Russia, India’s stock market rallied to an all-time-high in July, helping prop up investor confidence overseas. Citing stronger growth in India, the International Monetary Fund raised its 2023 global growth prediction.

Despite the strength in stocks, bond asset classes ended the month mixed. The US aggregate bond market fell 0.07% as the 10-year treasury yield increased from 3.81% to 3.97%, pushing bond prices lower. However, high-yield bonds once again followed riskier asset classes higher gaining 1.33% for the month. Volatile interest rates have remained a headwind for bonds, but higher interest payments have at least helped bonds hold up better than last year (US aggregate bonds are still up 2.02% YTD).

Markets have been mostly favorable so far in 2023, but it’s important to keep things in perspective. Even after a blistering 38.12% rally for the Nasdaq this year, the index is still 10.5% below its all-time-high level. The Dow is up just 7.31% YTD, but is only 3.5% off its high as the blue-chip index was more steady during 2022’s sell-off. Last year’s laggards have quickly become this year’s leaders, and vice versa. This is why diversification is so important – getting rid of the potential to hit a home run so you don’t strike out. The goal is to achieve a more consistent outcome over the long-run while avoiding excessive losses at an inopportune time.

X marks the… Tweet?

Twitter announced it was replacing its iconic bird logo with an X. Elon Musk also tweeted (or x’d) that X.com now points to twitter.com. The company expects to eventually ditch the “Twitter” brand all together.

CEO Linda Yaccarino said the rebrand represents the company’s vision going forward. While Twitter changed the way people communicated via social media, X is looking to go further by turning it into an everything app (audio, video, messaging, marketplaces, payments/banking, etc).

X is hoping artificial intelligence can help power its transformation. Musk recently launched a new organization named xAI as well.

The overhaul comes amid falling ad revenues and rising competition. With an already heavy debt load, the company is hoping to become cash flow positive to afford the luxury of adding new features.

And one more for good luck…

That’s what the Fed told markets as they raised rates another 0.25% in July following the brief pause in June, bring rates up to the 5.25% – 5.50% range.

This was the 11th rate hike since March 2022 when rates were effectively zero. Now, rates are at the highest levels since the beginning of 2001.

Fed Chair Jerome Powell did leave the door open for another potential hike later this year, saying the central bank will make data-driven decisions on a meeting-by-meeting basis going forward. However, it was also noted inflation has moderated since last year’s highs, leaving room for a more permanent pause on the horizon.

Markets are pricing in that we’ve already reached the peak rate in the cycle, placing just a 17% probability on another increase in the September 20th Fed meeting.

Fun Facts

The National Association of Theatre Owners reported there were more than 200,000 tickets sold for same-day screenings of Barbie and Oppenheimer (i.e. Barbenheimer).

Competitive art was a sport in the Summer Olympics from 1912 to 1948 (can’t imagine why it was removed from the lineup).

No number before 1,000 contains the letter ‘A’ when spelled out.

The original name for the hashtag sign (or pound sign) is octothorpe, with ‘octo’ referring to the eight points in the # symbol.

Disclosure:

Winnow Wealth, LLC (“Winnow Wealth”) is a Registered Investment Adviser.

The information presented is not investment advice – it is for educational purposes only and is not an offer or solicitation for the sale or purchase of any securities or investment advisory services. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser when making investment decisions.

This content is intended to provide general information about Winnow Wealth. It is not intended to offer or deliver investment advice in any way. Information regarding investment services are provided solely to gain an understanding of our investment philosophy, our strategies and to be able to contact us for further information.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

Additional Important Disclosures may be found in the Winnow Wealth Form ADV Part 2A which we will provide upon request.

Investment advisory services also offered through Brookstone Wealth Advisors (BWA), a registered investment advisor. Winnow Wealth & BWA are independent of each other.

Copyright © 2024 Winnow Wealth, LLC

Winnow Wealth, LLC (“Winnow Wealth”) is a Registered Investment Advisor (“RIA”), located in the State of Texas. Winnow Wealth provides investment advisory and related services for clients nationally. Winnow Wealth will maintain all applicable registration and licenses as required by the various states in which Winnow Wealth conducts business, as applicable. Winnow Wealth renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion. Investment advisory services also offered through Brookstone Wealth Advisors (BWA), a registered investment advisor. Winnow Wealth & BWA are independent of each other.