Blog

Check out our latest market updates and important financial alerts

January 2024 Market Watch

January 17, 2024

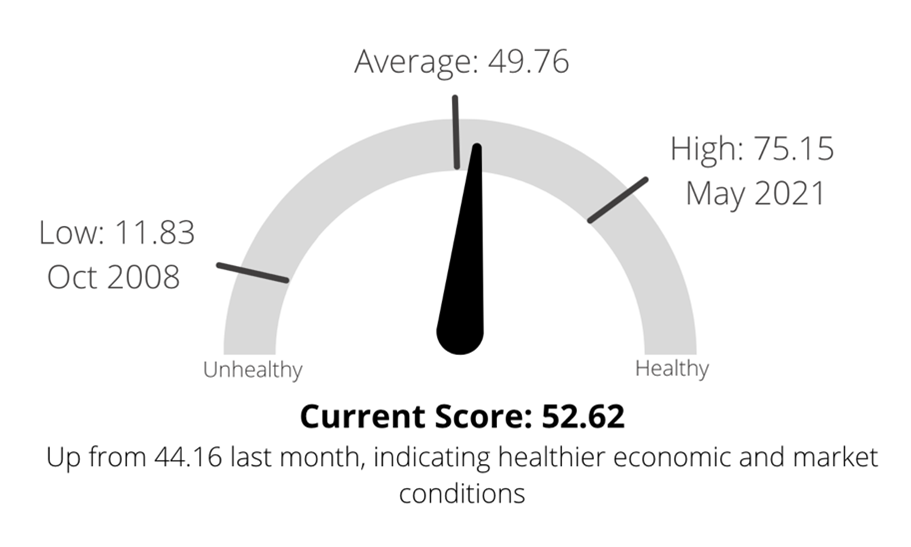

Market Health Indicator - Current Score

The Market Health Indicator (MHI) measures market health on a scale of 0 - 100, analyzing various market segments such as economics, technicals, and volatility. Higher scores indicate healthier market conditions.

What a difference a year can make

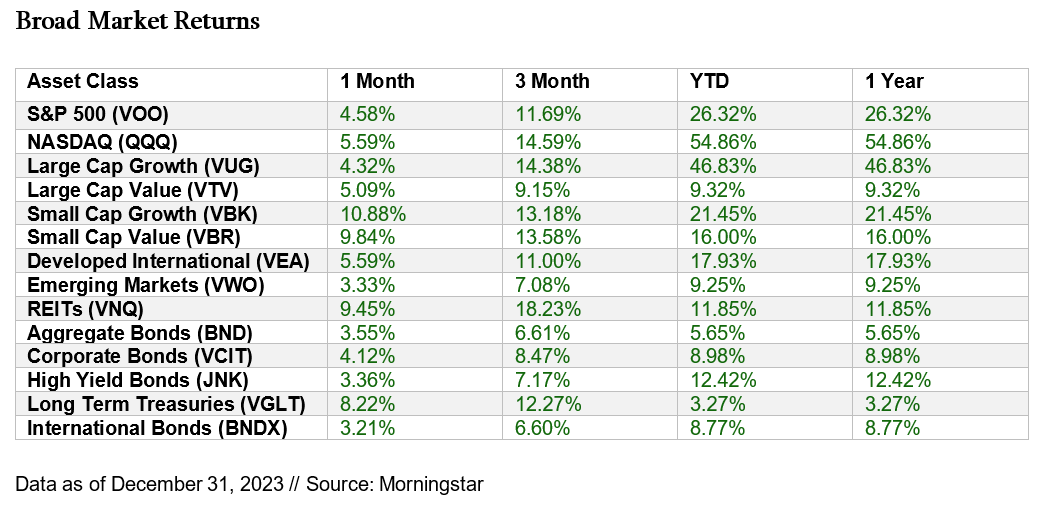

Markets ended 2023 on a high note posting back-to-back monthly gains to close out the year. Cooling inflation, combined with growing expectations of Fed rate cuts sooner than later resulted in a year-end rally, helping claw back a large portion of the losses experienced in 2022.

Small-cap stocks led the way higher, with the Russell 2000 surging 12.05%. Larger US indices also shared some holiday cheer with the Nasdaq, Dow Jones Industrial Average, and S&P 500 gaining 5.52%, 4.84%, and 4.42% respectively. The strong finish helped cement a relatively strong year for stocks as all of the aforementioned indices ended with double digit gains. However, not all sectors were created equal as technology gained 56% and utilities fell 7% for the year.

International markets were also higher as developed international stocks added 5.59% and emerging markets rose 3.33%. With heightened geopolitical tensions and slower economic expansion, markets overseas lagged the US, but still ended the year firmly in positive territory.

While the Fed left rates unchanged in its final meeting of the year, it hinted that rate cuts could be on the horizon. This shift in tone helped further relieve some pressure, resulting in a gain of 3.55% for aggregate US bonds as the 10-year Treasury yield fell from 4.37% to 3.88%. Despite a six-month losing streak earlier in the year amid rising rates, bonds were able to regain their footing and closed the year with a 5.65% gain. As rates have leveled off, bonds are in a more attractive position moving forward than where they were a couple years ago.

With inflation running high, recession risks rising, and bonds logging their worst year on record, there was plenty to be wary of coming into the year. There were some speed bumps along the way with the banking crisis and continued Fed rate hikes until recently, but when all was said and done 2023 was a good year for financial markets. This is why it’s important to have a plan in place, to help guide you through the inevitable ups and downs of the markets while keeping attention on what truly matters the most - achieving your goals over the long-run.

What do Alaska and Hawaii have in common?

In addition to being awkward inserts on any US map, you can now add airlines to the list.

Alaska Airlines announced a surprise offer to purchase Hawaiian Airlines for $1.9 billion, which is expected to close in the next 9-18 months pending regulatory approval. The offer represents a 270% premium over Hawaiian’s valuation prior to the news.

While government agencies haven’t been kind to airline deals lately, Alaska and Hawaiian argue combining would help them compete with the larger airlines.

As of now, 80% of domestic air traffic is dominated by four players - American, Delta, Southwest, and United.

If the acquisition goes through, Alaska would become the fifth largest US airline with an 8% market share.

Out of this world snacks

McDonald’s opened the first location of its new restaurant concept, CosMc, in Illinois.

Named after the alien cyborg creature featured in its ads in the 1980s and 90s, the spinoff is focusing on caffeinated drinks and afternoon snacks rather than traditional meals.

CEO Chris Kempczinski told investors the beverage and snack category is growing faster than fast food as a whole.

However, it’s also understood this is a test. The company will open 10 total CosMc’s by the end of 2024, and then it will spend a year analyzing data to decide whether or not to continue the chain.

Either way, the mothership is planning on expanding. McDonald’s expects to open 10,000 restaurants around the world over the next four years.

Fun Facts

Jackson Hole Mountain Resort’s first-ever Ski in Jeans Day saw a world record 3,114 people on the mountain skiing in denim.

77% of Americans said they opted for an artificial Christmas tree over a real one this year.

Clear off those coffee tables, January 29 is national Puzzle Day!

The first released version of Mickey Mouse, as depicted in Steamboat Willie, is now public domain (no longer protected as intellectual property).

Disclosure:

Winnow Wealth, LLC (“Winnow Wealth”) is a Registered Investment Adviser.

The information presented is not investment advice – it is for educational purposes only and is not an offer or solicitation for the sale or purchase of any securities or investment advisory services. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser when making investment decisions.

This content is intended to provide general information about Winnow Wealth. It is not intended to offer or deliver investment advice in any way. Information regarding investment services are provided solely to gain an understanding of our investment philosophy, our strategies and to be able to contact us for further information.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

Additional Important Disclosures may be found in the Winnow Wealth Form ADV Part 2A which we will provide upon request.

Investment advisory services also offered through Brookstone Wealth Advisors (BWA), a registered investment advisor. Winnow Wealth & BWA are independent of each other.

Copyright © 2024 Winnow Wealth, LLC

Winnow Wealth, LLC (“Winnow Wealth”) is a Registered Investment Advisor (“RIA”), located in the State of Texas. Winnow Wealth provides investment advisory and related services for clients nationally. Winnow Wealth will maintain all applicable registration and licenses as required by the various states in which Winnow Wealth conducts business, as applicable. Winnow Wealth renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion. Investment advisory services also offered through Brookstone Wealth Advisors (BWA), a registered investment advisor. Winnow Wealth & BWA are independent of each other.