Blog

Check out our latest market updates and important financial alerts

June 2024 Market Watch

June 7, 2024

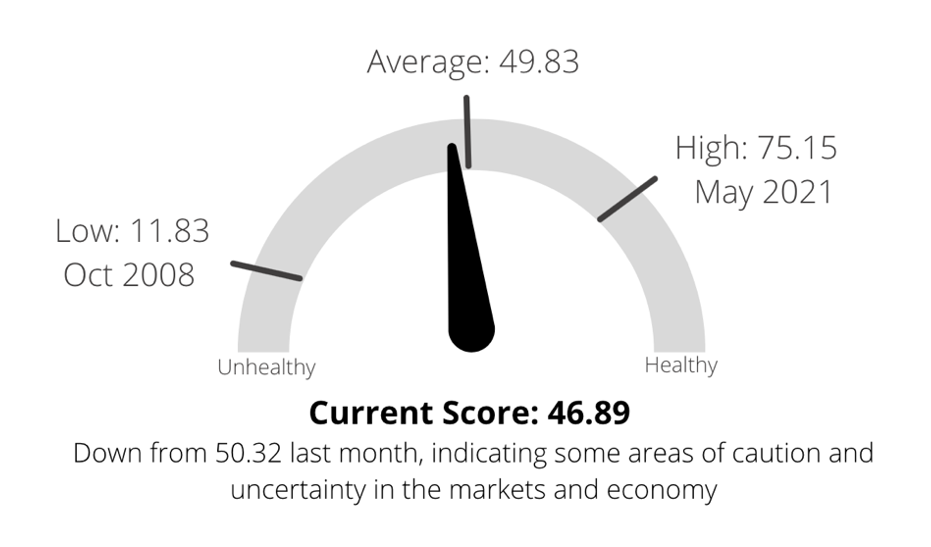

Market Health Indicator - Current Score

The Market Health Indicator (MHI) measures market health on a scale of 0 - 100, analyzing various market segments such as economics, technicals, and volatility. Higher scores indicate healthier market conditions.

This year’s April showers did bring May flowers, much to the delight of investors

Markets resumed their rally in May following a pullback in April. While there’s still some uncertainty regarding the path of potential Fed rate cuts, inflation was more in line with expectations for the month, helping ease some interest rate concerns. At the moment, markets are still pricing in a first cut in September.

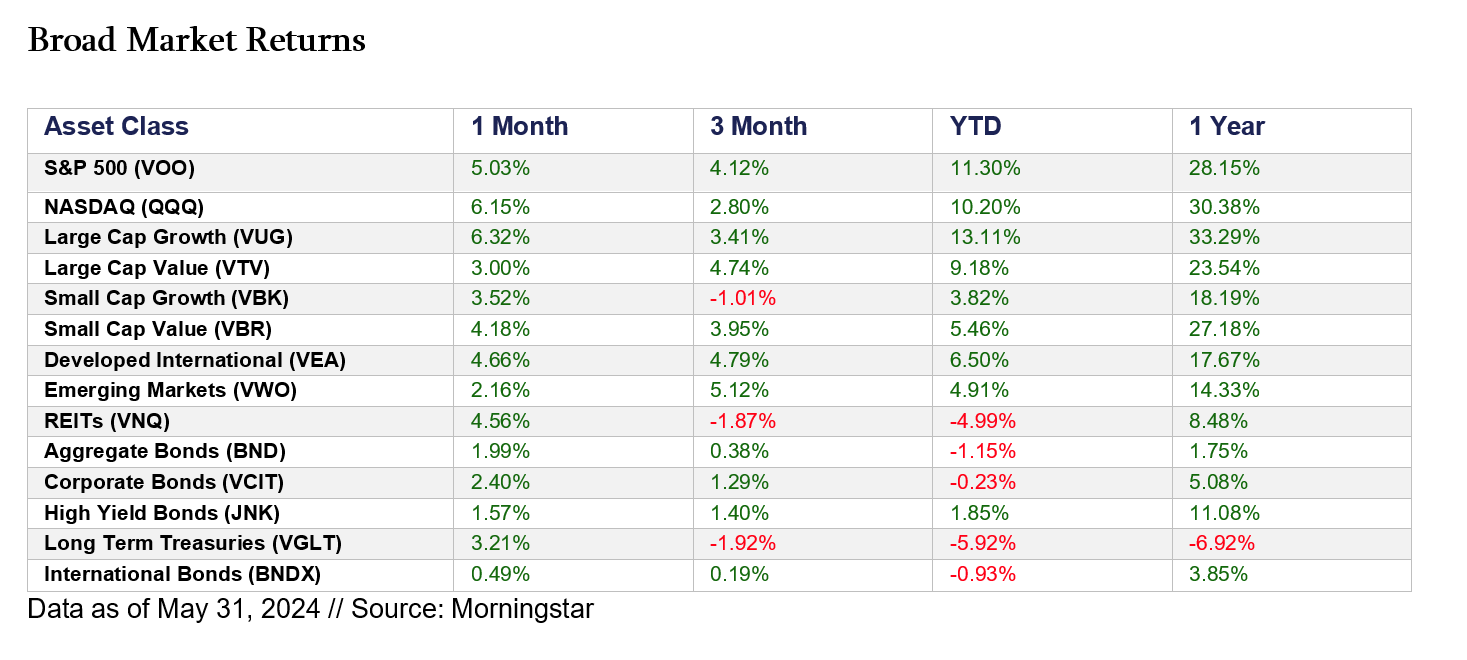

Large-cap US stock indices led the way higher, with the Nasdaq 100, S&P 500, and Dow Jones Industrial Average gaining 6.28%, 4.80%, and 2.30% respectively. Small-cap stocks also pushed higher, with a gain of 4.87% for the Russell 2000. As a whole, cyclical sectors outpaced more defensive sectors.

International markets trailed the US, though still ended the month with modest gains. Developed international stocks rose 4.66% while emerging market stocks increased 2.16%. While a higher degree of commodity exposure helped emerging countries in April, slumping oil prices combined with ongoing challenges in China’s economy created a headwind overseas in May.

The Fed left rates unchanged in its early-May meeting, which was the expected result. As investors await further guidance on the path of potential rate cuts, interest rates reversed course after spiking higher in April. The 10-year treasury yield dipped from 4.69% to 4.51%, boosting aggregate US bonds to a 1.99% gain. High yield bonds were also positive as credit spreads remain relatively healthy. Traditional bonds are still slightly negative year-to-date, but as rates continue to level off it could create more stability moving forward.

While May was strong across the board, the past couple months provide a great example of how markets can ebb and flow. As experienced in April, market pullbacks are normal and should be expected, even in the midst of a bull rally. Having a plan and investment strategy can help cut through the volatility and noise, helping to keep attention on the bigger picture.

FTX had some good news, bad news for its former customers

After imploding in 2022, a team was assigned to take over the bankrupt crypto exchange to liquidate assets in attempt to repay its account holders.

Good news first - the exchange confirmed it had recovered enough to pay back its clients with interest.

The bad news? FTX said customers would be repaid based on the dollar value of their crypto in November 2022, not the coins themselves.

For reference, bitcoin was worth about $18k at the time, compared to around $70k per coin today.

Some customers are still angry, as they want their coins back due to the missed opportunity cost from the recent rally. Others are just happy to be receiving anything back.

Actress Scarlett Johansson dislikes the sound of her voice so much she called her lawyers to fix it...

OpenAI unveiled a demo of its new ChatGPT-4o model, which includes a “voice mode” to help answer questions.

The model launched with five voice options, and one sounded eerily similar to Johansson. This prompted the actress and her team to send multiple letters demanding the company reveal how it created the voice assistant.

In 2013, Johansson voiced an AI in the movie Her. OpenAI CEO Sam Altman has cited the movie as partially inspiring the vision for ChatGPT, and Altman had even reached out asking Johansson to be the voice of the model, though she declined.

Johansson isn’t the only one asking questions. Many authors, actors, and news sources have sued AI companies for using their work without the creators’ consent.

Fun Facts

Only three US states don’t have any billionaires - Alaska, Delaware, and West Virginia.

Coffee consumption in the US has dropped close to 50% since its peak in 1946.

Father’s Day is on June 16th. According to the US Census Bureau, the necktie is the most popular of all Father's Day gifts.

Studies show wearing a necktie can reduce blood flow to your brain by up to 7.5%… maybe time to start looking into some new gift ideas?

Disclosure:

Winnow Wealth, LLC (“Winnow Wealth”) is a Registered Investment Adviser.

The information presented is not investment advice – it is for educational purposes only and is not an offer or solicitation for the sale or purchase of any securities or investment advisory services. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial adviser when making investment decisions.

This content is intended to provide general information about Winnow Wealth. It is not intended to offer or deliver investment advice in any way. Information regarding investment services are provided solely to gain an understanding of our investment philosophy, our strategies and to be able to contact us for further information.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

Additional Important Disclosures may be found in the Winnow Wealth Form ADV Part 2A which we will provide upon request.

Investment advisory services also offered through Brookstone Wealth Advisors (BWA), a registered investment advisor. Winnow Wealth & BWA are independent of each other.

Copyright © 2025 Winnow Wealth, LLC

Winnow Wealth, LLC (“Winnow Wealth”) is a Registered Investment Advisor (“RIA”), located in the State of Texas. Winnow Wealth provides investment advisory and related services for clients nationally. Winnow Wealth will maintain all applicable registration and licenses as required by the various states in which Winnow Wealth conducts business, as applicable. Winnow Wealth renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion. Investment advisory services also offered through Brookstone Wealth Advisors (BWA), a registered investment advisor. Winnow Wealth & BWA are independent of each other.