Getting Started with your Inventory Map involves THREE simple steps:

Step ONE

Use the button below to schedule your Right FIT Call at a time that works for your schedule.

Step TWO

Prepare by gathering the following items as applicable. You'll need to have these items handy during Step Three.

Real estate owned (approx. market value)

Loan balances (credit card, home, auto, student)

Retirement account balances: 401(k)s, IRAs, Roth IRAs, Profit Sharing Plans, etc.

Investment account balances (brokerage and mutual fund accounts) and respective bank/institution names

Cash balances (approx.) in checking, savings, CDs, Money Market accounts

Insurance coverage details (life, long term care, disability)

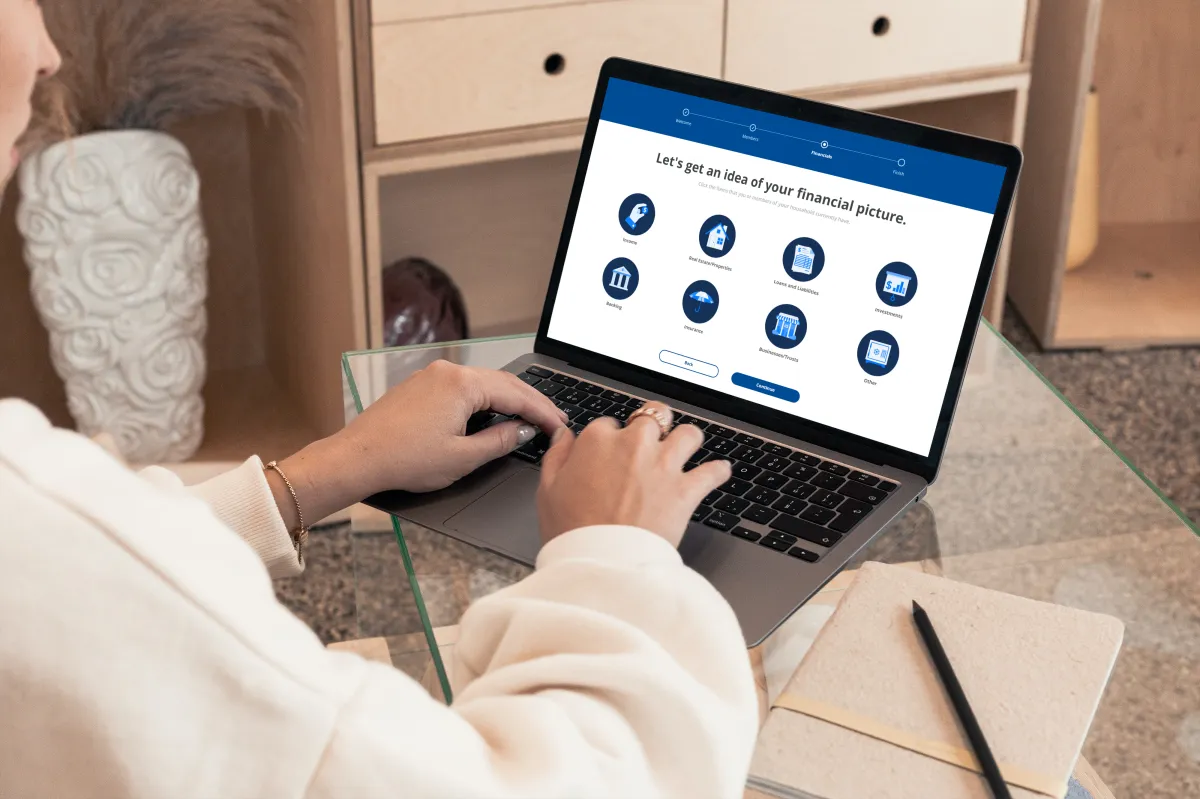

Step THREE

After your scheduled Right FIT Call, we'll email you a link to begin the I-Map Discovery Process online where you'll input details about your household's financial situation. It's a brief 10 to 15-minute task, and please note that the process cannot be saved to resume later.

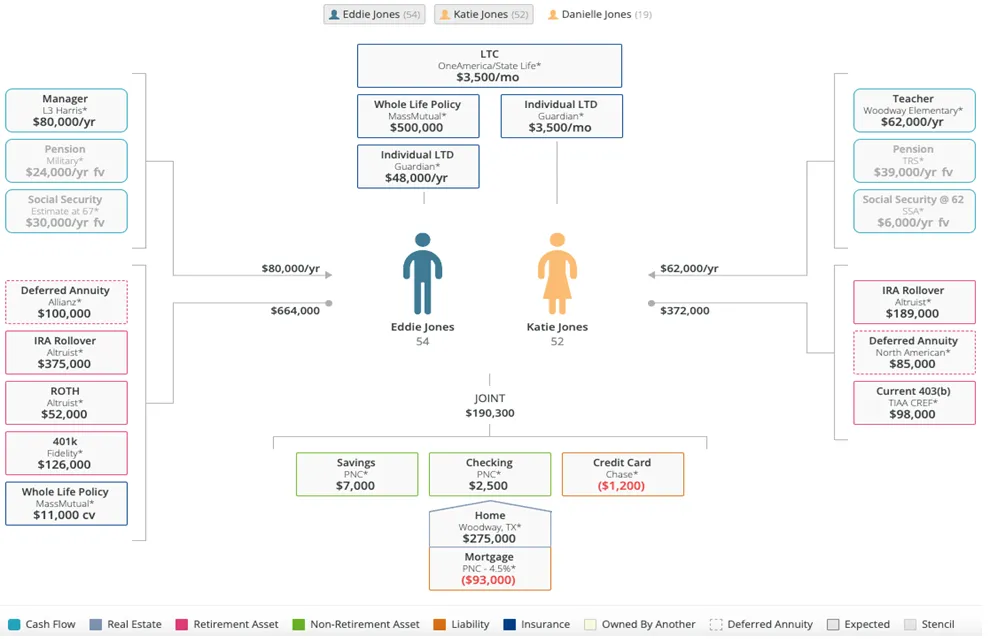

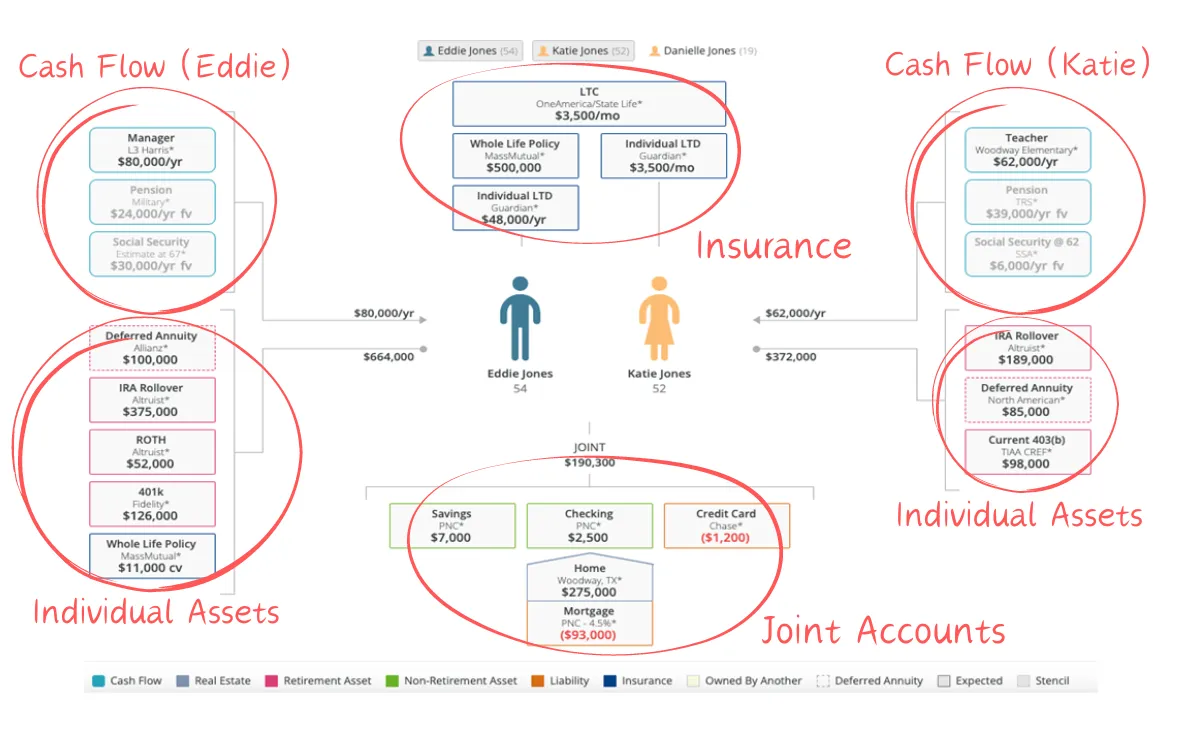

Benefits of our Inventory Map ("I-Map")

Goal-Oriented Mapping:

Use the I-Map to set and prioritize financial goals - crucial for Step One (Harvest) of our Winnow Way Process

Uncover Inefficiencies:

Illuminate financial inefficiencies to allow for smart decision-making.

One-Page Simplicity:

Visualize your household's financial life on a single page for streamlined oversight.

Copyright © 2025 Winnow Wealth, LLC

Winnow Wealth, LLC (“Winnow Wealth”) is a Registered Investment Advisor (“RIA”), located in the State of Texas. Winnow Wealth provides investment advisory and related services for clients nationally. Winnow Wealth will maintain all applicable registration and licenses as required by the various states in which Winnow Wealth conducts business, as applicable. Winnow Wealth renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion. Investment advisory services also offered through Brookstone Wealth Advisors (BWA), a registered investment advisor. Winnow Wealth & BWA are independent of each other.