BROWSE OUR BLOG TO LEARN MORE ABOUT RETIREMENT PLANNING, TAXES, AND MORE!

A Brief History of the Social Security COLA

Although to some of us it may seem as if Social Security has always been around, that isn’t the case. The Social Security Act was signed into law by President Franklin D. Roosevelt on August 14, 1935. Its aim was to address the economic hardships of the Great Depression and provide an income source, specifically for the elderly. But automatic [...]

A How-To Guide to Your “my Social Security” Account

While the Social Security Administration will still mail you a statement once a year if you’re over the age of 60, they really encourage everyone to create a “my Social Security” account for better security and easier access to forms and information. With an online account, you don’t have to wait for the mail to arrive or worry whether you missed your letter, and [...]

How to Build a Meaningful Retirement Life Without a Work Schedule

One of the most underestimated challenges of retirement is not financial but personal. After decades of structured workdays, many retirees find themselves asking, “What now?” While the initial freedom can feel liberating, the absence of a daily routine can quickly lead to boredom, lack of purpose, or even depression and heart disease![1] Creating a meaningful daily life in retirement may [...]

Your 2026 Social Security Cost-of-Living Adjustment: The Good News, The Bad News and What It Means for Your Retirement

Every October, over 70 million Americans eagerly wait for the Social Security Administration (SSA) to announce the Cost-of-Living Adjustment (COLA). This annual bump is designed to help your benefits keep pace with inflation, but will this actually help you cover your expenses, and what does this adjustment really mean for your wallet? Let’s take a look at these questions and [...]

5 Pillars of a Well-Constructed Retirement Plan

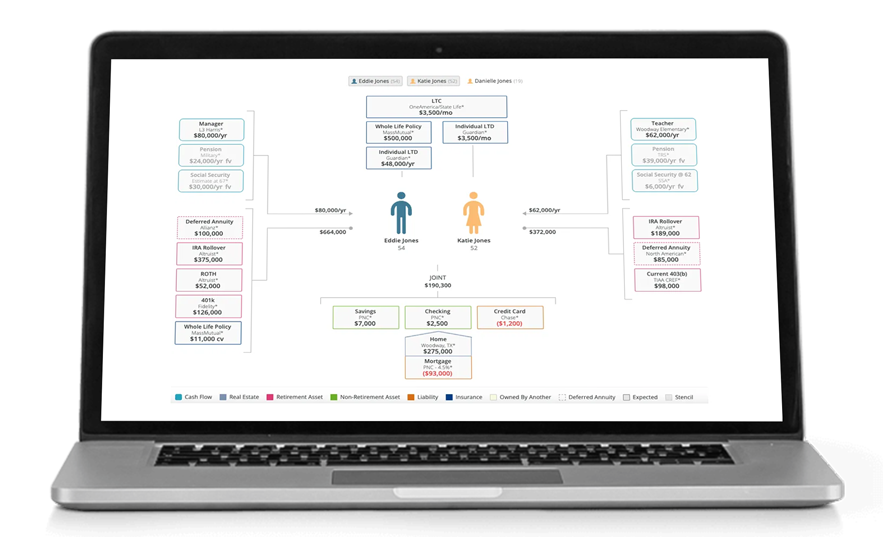

A well-planned retirement is not a single event, but a comprehensive strategy built on several interconnected pillars. As we look ahead for 2026 and the years to follow, it's more important than ever to ensure your plan is built for stability and flexibility. Beyond simply saving money, a truly successful retirement blueprint addresses five critical elements that work together to [...]

Give the Gift of Financial Planning This Holiday Season

As we gather with family and friends this week, many of us have spent time picking out the perfect gifts to wrap and lovingly place under the tree. We eagerly await them opening our gift and sharing in the joy we had while selecting it especially for them. And though traditional presents like gadgets and gift cards are always appreciated, [...]

5 Year-End Financial Moves for the Holidays

As the year winds down and the holiday season approaches, December brings a natural opportunity to pause, reflect, and realign. For retirees, this season is a perfect time to give your financial life a little attention before the calendar flips to a new year. Annual limits and other financial standards refresh at the end of the year as well, so [...]

Should I Keep My Retirement Account or Use Annuities?

Deciding whether to keep your retirement savings in accounts like IRAs or 401(k)s versus transferring those funds to an annuity is a question many people face as they approach retirement. But before we jump in, there’s no rule that says you have to pick one, and both offer different benefits and come with different limits and risks. In order to [...]